Are You Afraid of The Current Interest Rates?

Are you a Home Buyer that is afraid of the current interest rates and don’t know where to start? Then you are like many other Canadians. The fact of the matter is that interest rates had to go up in order to curb the rapidly climbing inflation rate that we were seeing at the end of 2022. So do the increased interest rates mean you can’t buy a home? The answer is NO! You need to get the facts and understand what is happening and you don’t have to be afraid of the current interest rates any longer.

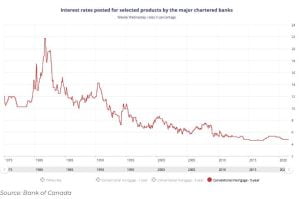

According to this graph from the Bank of Canada, showing the history of interest rates since 1975, we are relatively still low. Yes, I understand that the cost of homes is much higher than previously but let’s be real, so are wages.

We need to look at the real picture. Interest rates are affecting everyone differently. We have a large portion of our population that are baby boomers who are approaching retirement and have accumulated a great deal of savings so the interest rates are not as catastrophic for these people. For the first-time home buyers, you may feel the thought of home ownership is just farther and farther away. Not necessarily.

Yes, the higher interest rates mean that you have to qualify at a higher rate, which may reduce the amount you were hoping to borrow. On the brighter side of things, the cost of homes has decreased over the past two years and now you may not need to borrow as much as you originally had thought. Our advice to First Time Home Buyers is to just get into the market. If you can pay rent then you can pay a mortgage! You are already paying the landlord’s mortgage! Don’t look for your forever home but look at what you can afford to put your toe into home ownership. You cannot save as much as the values of properties increase in the same amount of time.

The question then becomes down payment. Have you saved enough? Can a family member gift you a down payment to help you get started? What about buying a home with a friend or another couple and making it a business venture? Every situation is different and we would be happy to have a coffee and look at options with you.

Let’s say you have saved the down payment, now is the time to get your pre-approval and lock in your rate. This gives you the assurance for the next 120 days that your interest rate will not increase. If rates go down then you can qualify again at the lower rate. Everyone has different opinions on using a bank v.s. a mortgage broker. My personal opinion is a mortgage broker tends to have more options for you and every situation is different so options tend to be beneficial in the long run.

The biggest thing for anyone who is afraid of the current interest rates is to get real with your finances. Look at your spending. Track your spending for one month. This is an exercise I have done in the past and it was quite surprising to see where the little bits start to add up here and there. Most people feel like they have more month than they do money but when they do a real analysis of where the money goes, often they find there is quite a bit of waste. How many times do you grab a coffee or eat out? How about quick stops to pick up a few things at the grocery store and come out with $100 dollars of things you really didn’t need. The best answer is “it was on sale!” Mike’s favourite saying is go in and save 50% or stay out and save 100%. I challenge you to write down in a journal for just one month, every dollar that you spend. You will quickly see where you can make some minor adjustments and reap great rewards.

I love how so many people think they can “time” the market. If anyone had that crystal ball, I think they would be quite wealthy. There is no “perfect” time to buy. Think of a gas station. You are on your way to work and think I need to get gas but you are running late so you will do it on your way home. In the morning the gas was $1.50. After work the gas is now $1.63. Gas prices constantly fluctuate. So does the market. You just need to decide that you are making the decision to own a home and get off the rental merry-go-round. Reach out to one of the Mullin Group Team Members and we can walk you through step-by-step the buying process and help get you On The Move!

Contact us at 519-827-2119 for a confidential and informative consultation.

Search current listings here: https://mullingroup.ca/listings/

We look forward to helping you achieve your goals.