Can We Afford to Buy Now? Let’s Do The Math!

It is very apparent there have been changes to the Real Estate Market in the last 9 months. There is so much talk on the news channels and social media sites about housing and affordability. Many people are asking themselves, can we afford to buy now? We think you can! Let’s do the math!

February 2022 saw the greatest increase in housing prices across all market areas but especially here in the Orangeville area. Due to many factors including gas prices, mortgage rate increases and the war in Ukraine, the market adjusted. The prices we were seeing in the yearly part of the year were not healthy and sustainable. We are back to a more reasonable, healthy real estate market.

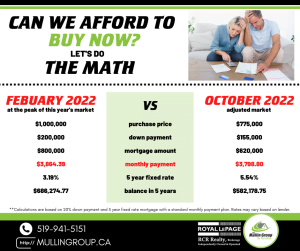

Sheila has taken the time to do a little math to run the comparisons of then vs now in the market. We understand logically that when interest rates rise, we are paying more in borrowing costs than going towards the principal amount; however every person needs a place to live. Whether you are making mortgage payments or rent payments it comes down to affordability. Typically people look at how much they can afford each month.

We have also broken this down in the diagram below. First thing to note is that you do not need as much of a down payment to get into today’s market. Having 20% down helps you avoid the insurance premiums on a high ratio mortgage. You also have the opportunity in this market to put conditions back into your offers like home inspections and financing clauses. This is definitely a benefit to buyers. When you look at the monthly payment based on purchase prices being lower for the exact same house now compared to last February even with a higher interest rate, your monthly payment is lower!

If you are a person that bought back in the height of the market, we do not want you to panic. In the history of the real estate ever since housing prices have been tracked, values have gone up. There were some dips in markets in some years but over time the value of your investment has increased. All indicators are predicting the market to remain strong and healthy for 2023. Unless you were making a plan to sell within a couple of years, we believe your investment will grow.

We believe you need to talk to a real professional with regards to real estate and what is happening in the market today. The news sells on sensationalizing information. Seeing actual statistics and sale prices should calm your fears.

If you are an investor that has wanted to get into the market, this is a perfect time for you to buy an income property because rents have also gone up to help with your increased carrying costs.

We believe real estate is one of the best investments ever! This market adjustment may just be the right time for you to answer the question “can we afford to buy now?” Better question is can you afford not to buy now? Reach out to The Mullin Group and we would love to sit and go over your goals and run the numbers with you!